(Family Features) Once a one-day shopping extravaganza defined by long lines and doorbuster deals, Black Friday has transformed into a season of rolling discounts and fading excitement.

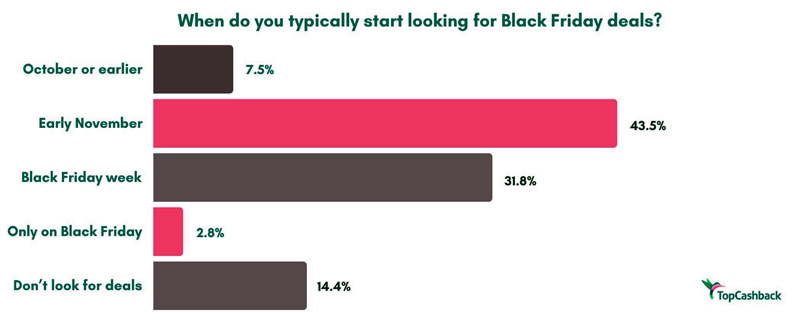

According to new research from TopCashback, nearly 7 in 10 Americans no longer consider Black Friday a one-day event, viewing it instead as a month-long shopping season. Only about one-third still see it as a single-day tradition. More than half of respondents said they now shop online instead of in stores, and 43% start scouting deals in early November.

Findings suggest Black Friday’s sense of urgency has shifted, replaced by a steady flow of rolling discounts and digital promotions. What was once a race for the best bargains has become a marathon for savings.

The evolution of Black Friday appears to be changing how people spend, too. While 18% of shoppers said they spend less now than they did five years ago, another 18% said their habits haven’t changed much. Only 3% reported spending more. For many, the shift seems to be less about budget and more about timing.

Asked whether they’d prefer Black Friday return to a single-day event, 44% said they like having more time to shop, while 26% said a one-day version would feel “less overwhelming.” The rest simply don’t mind either way.

“Consumers are rethinking how they approach major sales events,” said Destiny Chatman, consumer analyst at TopCashback. “They still want value, but they’re less willing to be rushed. The new Black Friday is about planning, timing and feeling in control of spending.”

The research also found shoppers are increasingly aware of the marketing tactics behind the hype. Two-thirds said they believe brands create fake urgency around Black Friday, and another 30% said they think it happens “sometimes.” Despite the skepticism, most still admit deep discounts drive their decisions – nearly 87% said upfront savings are their top motivator, compared with just 6% who said they’re most influenced by cash back or rewards.

Still, money-back incentives aren’t without impact. Four in 10 respondents said they’ve made a purchase specifically because cash back was offered, and about half said they’d consider choosing a smaller discount if it came with meaningful rewards. Electronics and tech ranked as the top categories where shoppers expect to earn the most cash back, followed by fashion and beauty.

Even with the season stretching longer, the emotional rollercoaster of Black Friday remains. Most respondents said they feel neutral after shopping while 33% said they feel proud of the deals they scored. Smaller groups reported guilt or regret after their purchases.

Impulse buying persists with more than 62% saying they occasionally buy things they didn’t plan to, and nearly 1 in 5 said it happens most years. Still, only 5% said they always feel pressured by sales, though 39% said they sometimes do.

For 68% of shoppers, seeing a huge percentage off is what makes them feel best about spending. Another 8% said they enjoy feeling like they “beat the system” and 7% said earning cash back brings them satisfaction.

“People want to feel proud about their spending,” Chatman said. “They’re realizing that a good deal isn’t just about price in this economy. It’s about timing, confidence and getting something that feels worthwhile.”

If Black Friday disappeared altogether, 55% of Americans said they’d be indifferent. Only 31% said they’d be disappointed while 13% admitted they’d feel relieved to skip the pressure.

For all its changes, Black Friday still reflects the psychology of modern spending: the balance between excitement and restraint, hype and habit. Experts say shoppers can make the most of the season by planning ahead, comparing prices over time and focusing on rewards that add long-term value rather than chasing every flash sale.

“Black Friday isn’t gone; it’s simply grown up,” Chatman said. “Today’s shopper is more strategic, less impulsive and more aware of what makes a deal truly worth it.”

To find more information, visit TopCashback.com.

Photo courtesy of Shutterstock (woman using laptop)

Source: TopCashback